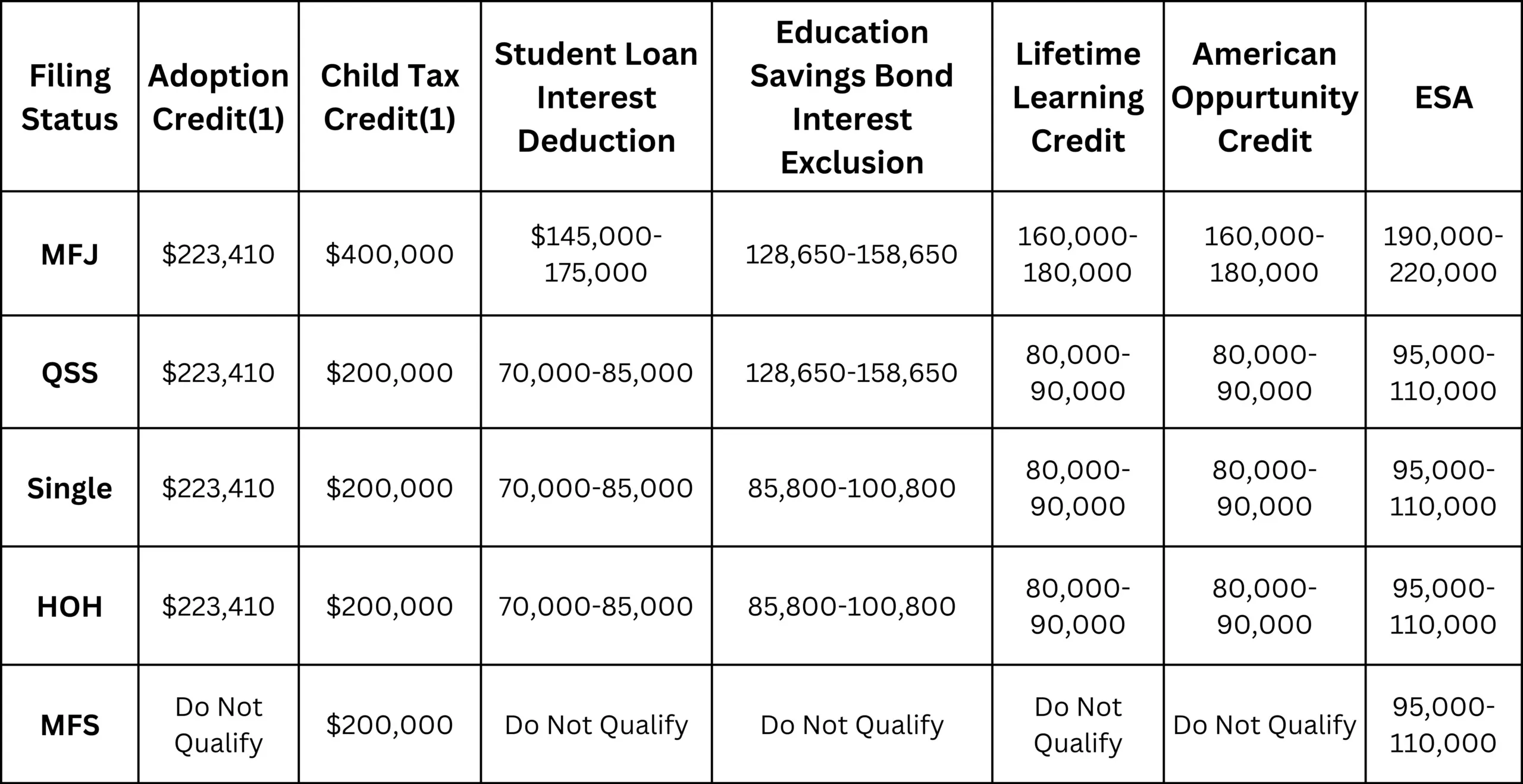

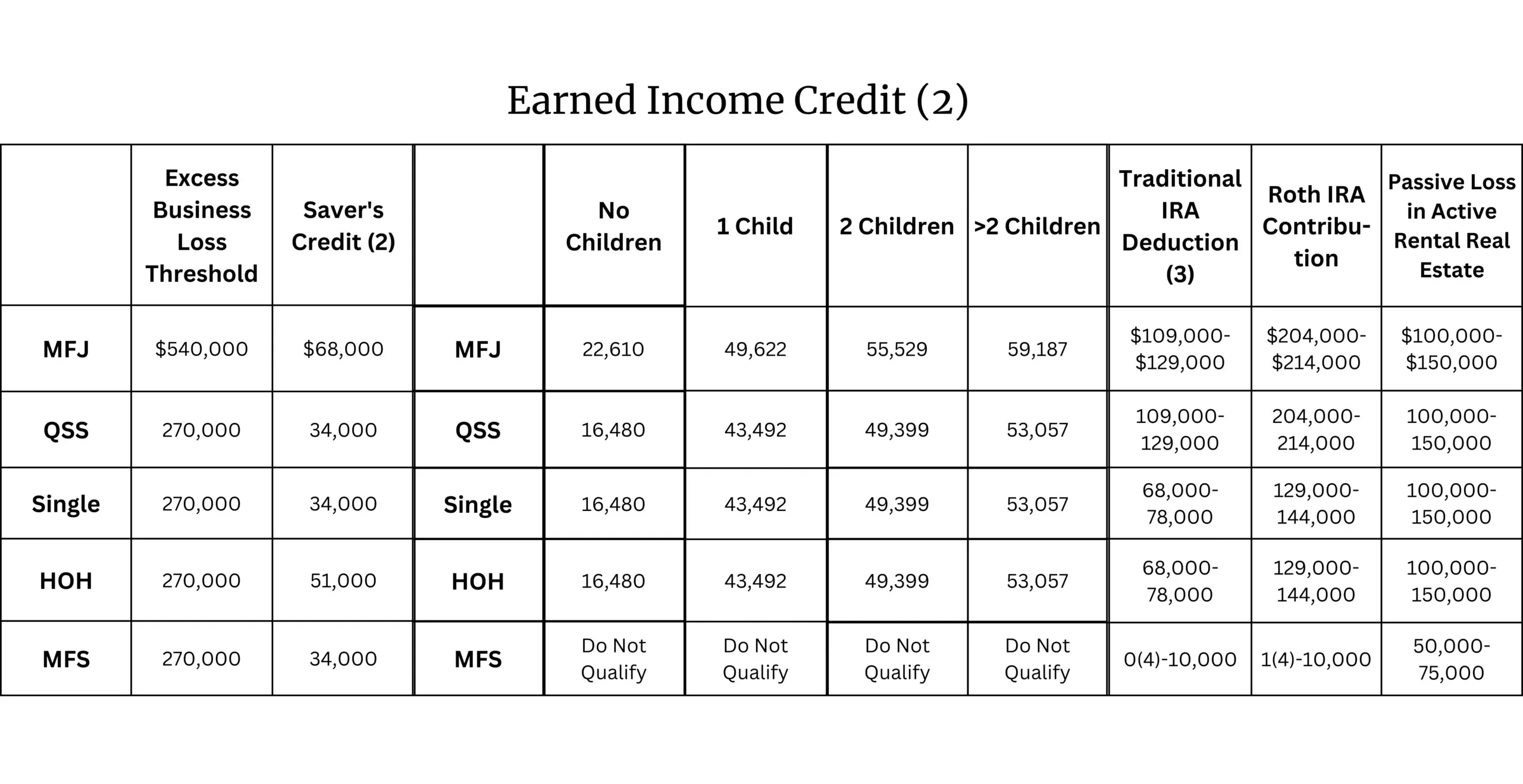

1 Amount at which phase-out begins.

2 Amount at which phase-out is complete.

3 Phase-out that applies if taxpayer is covered by an employer retirement plan. For MFJ, phase-out range for non-covered spouse is $204,000–$214,000.

4 Married individuals filing MFS who live apart at all times during the year are treated as single.